Navigating the complexities of tax filing, individuals and businesses alike are faced with a fundamental choice: the traditional method of paper filing or the convenience of electronic submission. This article delves into the pros and cons of paper filing taxes, providing a comprehensive analysis of the advantages and drawbacks associated with this approach.

From security concerns to organizational challenges, the nuances of paper filing taxes are explored in depth, offering valuable insights for informed decision-making.

Pros and Cons of Paper Filing Taxes

The decision between paper and electronic tax filing involves weighing various factors such as security, convenience, accuracy, organization, cost, technological requirements, legal considerations, and long-term accessibility.

Security and Privacy

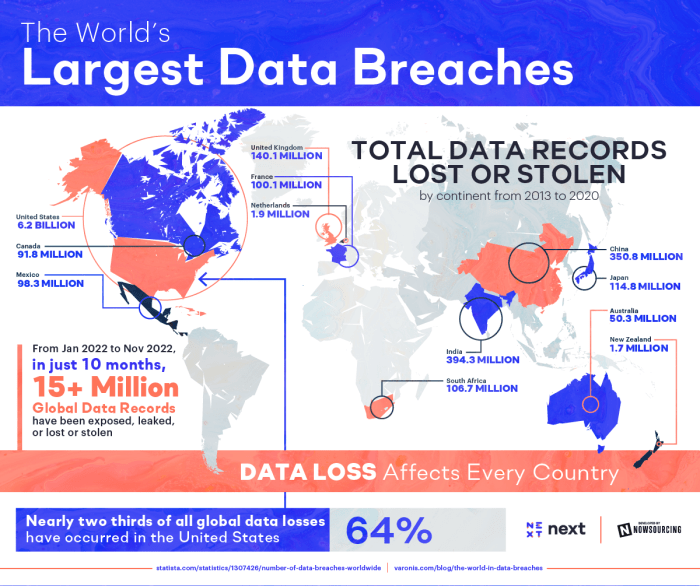

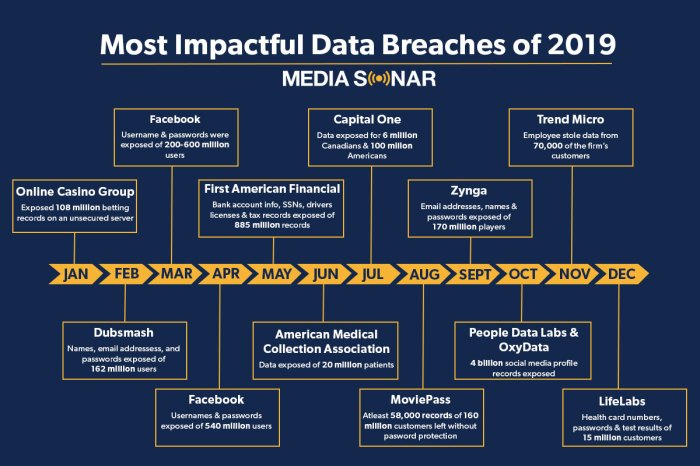

Paper tax filings pose security and privacy risks due to their physical nature. The documents can be lost, stolen, or accessed by unauthorized individuals, leading to potential data breaches, fraud, and identity theft.

Electronic filing, on the other hand, offers enhanced security measures such as encryption, digital signatures, and two-factor authentication. These measures protect sensitive tax information from unauthorized access and ensure data integrity.

Convenience and Accessibility, Pros and cons of paper filing taxes

Electronic tax filing is highly convenient and accessible. Taxpayers can file their returns from anywhere with an internet connection, saving time and effort compared to mailing paper documents.

According to the IRS, over 90% of individual tax returns are filed electronically, demonstrating the widespread adoption and ease of use of electronic filing options.

Accuracy and Errors

Electronic tax filing systems incorporate automated error checks and validation processes, reducing the likelihood of human error compared to manual data entry in paper filings.

Studies have shown that electronic filing significantly reduces the number of errors in tax returns, leading to faster processing times and a lower risk of audits.

Organization and Record-Keeping

Paper tax documents can be challenging to organize and store securely. They require physical space and are susceptible to damage or loss.

Electronic filing offers digital storage and cloud-based backups, ensuring easy retrieval of tax records and reducing the risk of losing important documents. Additionally, electronic filing promotes environmental sustainability by reducing paper waste.

Cost and Efficiency

Electronic tax filing can be more cost-effective than paper filing, eliminating expenses such as postage, printing, and copying.

Businesses and individuals have reported significant savings in time and money by switching to electronic filing. The automated processes and reduced manual labor lead to increased efficiency and productivity.

Key Questions Answered: Pros And Cons Of Paper Filing Taxes

What are the primary advantages of paper filing taxes?

Paper filing provides a sense of familiarity, allows for physical organization of documents, and may be preferred by individuals who lack access to technology or prefer a traditional approach.

Are there any security risks associated with paper filing taxes?

Yes, paper filing poses risks such as data breaches, fraud, and identity theft due to the physical nature of the documents and the potential for mishandling or loss.

How does electronic filing compare to paper filing in terms of accuracy?

Electronic filing generally offers higher accuracy due to automated error checks and reduced risk of human error during manual data entry.