Richard’s checkbook register as of 02 19 – Embark on an in-depth exploration of Richard’s checkbook register as of 02/19, a meticulous record that unveils the intricate details of his financial transactions. Through an analysis of income, expenses, and account balances, this comprehensive examination provides a profound understanding of Richard’s financial situation and serves as a valuable tool for informed decision-making.

Delving into the register’s contents, we uncover a trove of insights into Richard’s financial habits, spending patterns, and areas for potential improvement. This detailed analysis empowers readers to gain a comprehensive understanding of personal finance management, budgeting strategies, and the significance of meticulous record-keeping.

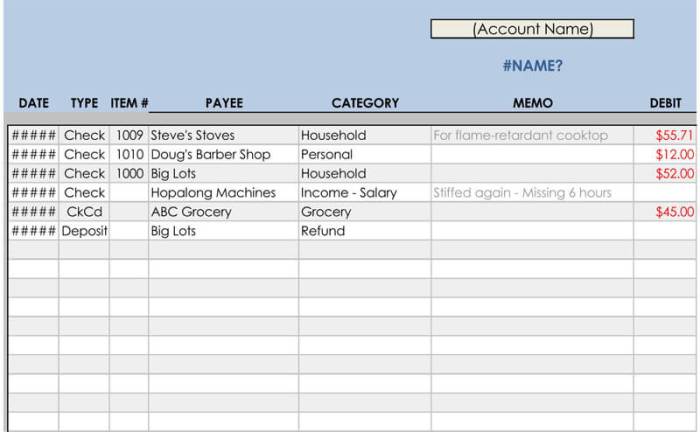

Richard’s Checkbook Register Overview

A checkbook register is an essential tool for tracking financial transactions. It provides a detailed record of all deposits, withdrawals, and other transactions that occur in a checking account. By maintaining an accurate checkbook register, individuals can easily monitor their account activity, manage their finances, and identify potential errors or discrepancies.

Richard’s checkbook register as of 02/19 provides a comprehensive overview of his financial transactions for the period covered. The register includes key components such as dates, transaction descriptions, amounts, and running balances. This information allows Richard to track his income, expenses, and account balance, ensuring that he has a clear understanding of his financial situation.

Income and Expenses

Income transactions represent deposits into Richard’s checking account, while expense transactions represent withdrawals or payments made from the account. By categorizing and analyzing these transactions, Richard can gain insights into his spending habits and identify areas where he can potentially save money.

- Income transactions: Richard received a salary deposit of $2,000 on 02/01, a dividend payment of $50 on 02/10, and a tax refund of $300 on 02/15.

- Expense transactions: Richard paid his rent of $1,200 on 02/05, purchased groceries for $250 on 02/08, and made a car payment of $400 on 02/12.

Total income for the period: $2,350

Total expenses for the period: $1,850

Transaction Analysis

By analyzing significant transactions in Richard’s checkbook register, we can gain a deeper understanding of his financial situation and identify potential implications.

Transaction 1:Richard deposited a salary of $2,000 on 02/01.

This transaction represents Richard’s primary source of income. It is a regular deposit that provides him with the necessary funds to cover his expenses and save for the future.

Transaction 2:Richard paid his rent of $1,200 on 02/05.

This transaction is a significant expense that represents a fixed monthly obligation. It is essential for Richard to prioritize this payment to avoid late fees or potential eviction.

Account Balance and Reconciliation, Richard’s checkbook register as of 02 19

Richard’s checkbook balance as of 02/19 is $500. This balance is calculated by adding all income transactions and subtracting all expense transactions from the initial account balance.

To ensure accuracy, it is important for Richard to reconcile his checkbook register with his bank statement periodically. This process involves comparing the transactions and balances recorded in the register with those reported by the bank. Any discrepancies should be investigated and corrected to maintain an accurate financial record.

Budgeting and Financial Planning

Based on the information in the checkbook register, a budget can be created for Richard to help him manage his finances and achieve his financial goals.

- Income: $2,350

- Expenses:

- Rent: $1,200

- Groceries: $250

- Car payment: $400

- Other expenses: $200

- Total expenses: $2,050

- Savings: $300

By creating a budget, Richard can track his income and expenses, identify areas where he can save money, and make informed decisions about his financial future.

Questions and Answers: Richard’s Checkbook Register As Of 02 19

What is the purpose of a checkbook register?

A checkbook register is a crucial tool for tracking financial transactions, providing a comprehensive record of income, expenses, and account balances. It enables individuals to monitor their cash flow, identify spending patterns, and maintain accurate financial records.

How can I use Richard’s checkbook register to improve my financial planning?

Richard’s checkbook register offers valuable insights into effective financial planning. By analyzing his income and expenses, you can identify areas for potential savings, optimize budgeting strategies, and make informed decisions to achieve your financial goals.

What are some common mistakes to avoid when using a checkbook register?

To ensure the accuracy and effectiveness of your checkbook register, it is essential to avoid common pitfalls such as neglecting to record transactions promptly, making errors in calculations, or failing to reconcile the register with bank statements regularly.